Selling Puts on Revolve

I didn't think I would have an opportunity to get back, but we are using Puts to establish a position

Introduction:

Welcome back to another write-up! I did not think that I would ever be writing about this company at least in the short term, but it has fallen a lot since I sold at the mid $80’s price. I decided to go ahead and sell some puts because the volatility on this company provides some nice premiums while being able to sell puts at a good strike price.

My original article on why I sold can be found here.

If you would like to watch my Youtube video explanation click here.

Disclaimer: I currently sold put contracts for RVLV and used to own this stock in this company.

RVLV - Revolve Group, Inc:

“REVOLVE is the next-generation fashion retailer for Millennial and Generation Z consumers. As a trusted, premium lifestyle brand, and a go-to online source for discovery and inspiration, we deliver an engaging customer experience from a vast yet curated offering of apparel, footwear, accessories and beauty styles. Our dynamic platform connects a deeply engaged community of millions of consumers, thousands of global fashion influencers, and hundreds of emerging, established and owned brands. Through more than 18 years of continued investment in technology, data analytics, and innovative marketing and merchandising strategies, we have built a powerful platform and brand that we believe is connecting with the next generation of consumers and is redefining fashion retail for the 21st century” Q3 10Q Filing Pg.22

Essentially, Revolve Group is a luxury retailer for a primarily female demographic which utilizes social media and data driven inventory control to maintain costs while getting consumers exactly the attire they want. Revolve and their premier brand FWRD are heavily reliant on events, festivals, and large concerts which obviously were put on hold all 2020. Since then, especially in 2021 & 2022, they have come back in full swing with events opening up around the globe which has allowed them to finally build out a healthy balance sheet and drive profit on the bottom line.

The management team is heavily invested in the success of this company by nearly owning half of the outstanding shares via the B shares. When the shutdown first rolled out, the Co-CEOs both stopped taking a salary and Revolve utilized a line of credit to ensure they would stay in business. I like having founder led companies who have skin in the game because they will care about where the company is going. Looking into the future it is important to watch votes and compensation to ensure that their voting power does not erode the company’s performance.

*Note: MMMK Development is owned by the CEOs.

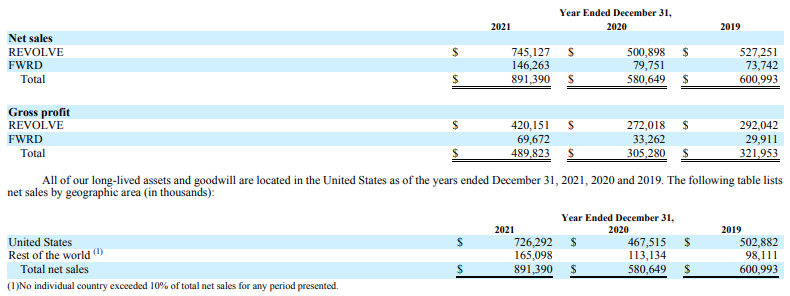

Revolve breaks itself down into the following segments:

Financials:

Total Revenue TTM as of Q1 2022: $995.981M

Profit Margin has been floating between ~8% - 10% over the last year

Current P/E: ~20

EV/EBITDA: ~16.03

Current Cash as of Q1 2022: $270.607M

Total Debt as of Q1 2022: $0.00

Why I sold:

I had originally sold because I thought that the company was significantly overvalued from where I bought the shares at. To give you an idea of its market value trajectory, it went from $7 in March 2020 to a high of $87 in November 2021. While I think that this company is a great compounder over the long term, I did not believe that it justified such a large valuation change. Now I had bought in with an average cost basis of $18 a share and sold out in the mid $80s. While I do not regret selling I would like to see if I can get back into it using options since the valuation has come back down to Earth and out of the atmosphere.

Strengths:

Close Relationships with Many Influencers

Their marketing from the beginning has been driven through micro-influencers, nano influencers, and celebrities alike due to these public figures giving exposure to the brand. This close relationship allows Revolve to tap into the millennial and GenZ crowds who are finally moving into higher and higher-paying jobs. Through this, they are able to afford Revolve and Forward’s products more. Now the stimulus checks along with a change in product offerings allowed the brand to be successful during shutdowns, but the company’s strategy is mostly revolving around big events such as festivals or large concerts.

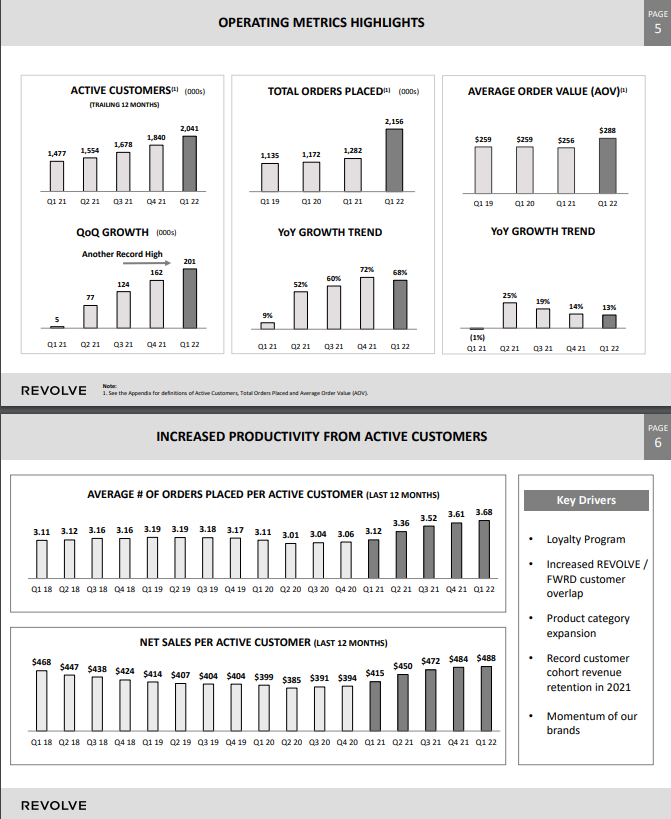

Operating Metrics

Active customers, orders, placed, and average order value are all trending in the right direction, but please be wary that a lot of it is driven by stimulus checks and spending. What I pay attention to the most is customer retention and customer loyalty to RVLV since recurring buys mean recurring revenue for Revolve. “Existing customers typically place more orders annually than new customers and at higher average order values, resulting in existing customers representing approximately 76% of orders and approximately 77% of net sales in 2021, up from 74% of orders and 76% of net sales in 2020 and 57% of orders and 58% of net sales in 2014, again having increased in each year.” 2021 10K Page 62

Customer Acquisition Cost

While the below screenshot comes from their S-1 filing from a couple of years ago it gives an idea as to what the company sees in terms of its customer acquisition cost versus their lifetime value. I would imagine that this metric looks a lot better now especially because of the stimulus spending, but they do not provide this metric in their current filings.

Weaknesses:

Inventory Management

One of the big weaknesses we have seen with other retailers is their oversupply of goods. While Revolve states that it uses data-driven analytics for its inventory…so does everyone else(whether human input error is a factor is something we shall see in retailers’ 10Qs). If Revolve over-ordered and had to write down some of its inventory then that can become an issue, especially within their fast-moving industry. While it is important for them to be able to control all of their inventory using technology it opens up a hole to overorder or not move in the correct direction as far as the industry is concerned.

Third-party suppliers and manufacturers based primarily in China and shipping costs

A lot of their third-party suppliers are based in China, which can lead to increased shipping and freight costs due to most of their shipments being sent to customers in the U.S. We haven’t seen any crazy shortages yet for clothing retailers, but there have been some parts of China (like Shanghai) that have been shut down due to covid. While it is important to watch third-party suppliers, more than likely this is the case for most clothing companies at this point since so many outsource manufacturing.

Slowdown due to no stimulus and recession fears

Revolve had an awesome end of 2020 through Q1 2022 as far as revenue is concerned along with some increasing gross margin. A lot of the sales were made due to everything opening back up at the same time, festivals/events coming back, and of course stimulus checks. While I do not think they will start losing sales in the near term, it is possible we see a slow down due to inflationary pressure, recession fears, and overall consumer spending habits.

Intrinsic Value:

Link to discounted cash flow here.

Why I sold Puts:

I like the intrinsic value around $15 - $18 and with a 20% margin of safety, I get $15.04. I decided to go ahead and sell puts at $15. A put option contract for Aug 2022 and another for Jan 2023. This will allow me to lock in a buy price while receiving some premium for waiting. The downside is that if the fundamentals were to change or if the stock price were to fall significantly below I am locked in to be put the shares at $15. Now overall my total premium for both contracts is $154.62 with a potential $3,000 being built out if the stock price goes to or below $15. I really hope it goes slightly below so I can be put the shares, but I won’t bank on it happening. If I start to see some weakness closer to my put price I may start adding shares. My plan is to get in this company with puts and hopefully get out of it years from now by selling calls. This will lower my overall cost basis and be useful to generate some cash while waiting for deals. Part of the risk with the selling puts is that the contracts tie up $3,000. This could mean some opportunity costs for another deal, but I will continue adding cash to hopefully avoid any opportunity cost issues.

Matthew Peterson did an excellent video with New Money here on how you can use selling calls and puts for value investing (Link). Investing with Tom and Hamish Hodder had a podcast with him as well(Link).

Conclusion

In conclusion, I am really hoping to get put the shares. A steadily growing company in the clothing industry will allow me to diversify between sectors while adding a good company. Through the next couple of earnings seasons, I will continue to watch what management says in case there are any concerns over consumer spending or any other fundamental factors that may change. As of right now, I will sit patiently on my hands, and if the August contract does not end up filling I will likely sell another put for Jan 2023.