Why I Sold Out of Revolve (RVLV)

I wanted to give an inside look at why I decided to sell RVLV and what drove my decision to sell.

Introduction:

This is one of the first stocks that I bought based on the real valuation metrics, research, and understanding of the underlying business. Everything else I had bought prior to this was either random trades or index funds. I am obviously proud of the results, but I went ahead and sold my position in the company because of the reasons I will go over in the points below. My fundamental view on the business model and management has not changed, but I achieved what I expected to get over the next few years in less than 1 year.

Here is my youtube video explaining why it is overvalued: (Link)

RVLV - Revolve Group, Inc:

“REVOLVE is the next-generation fashion retailer for Millennial and Generation Z consumers. As a trusted, premium lifestyle brand, and a go-to online source for discovery and inspiration, we deliver an engaging customer experience from a vast yet curated offering of apparel, footwear, accessories, and beauty styles. Our dynamic platform connects a deeply engaged community of millions of consumers, thousands of global fashion influencers, and hundreds of emerging, established, and owned brands. Through more than 18 years of continued investment in technology, data analytics, and innovative marketing and merchandising strategies, we have built a powerful platform and brand that we believe is connecting with the next generation of consumers and is redefining fashion retail for the 21st century” Q3 10Q Filing Pg.22

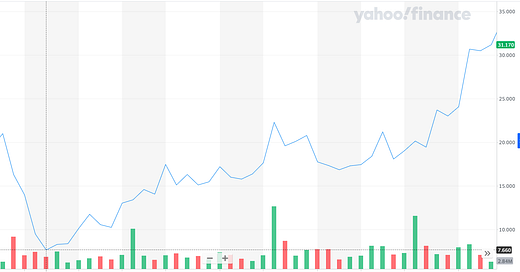

Essentially, Revolve Group is a luxury retailer for a primarily female demographic that utilizes social media and data-driven inventory control to maintain costs while getting consumers exactly the attire they want. Revolve and their premier brand FWRD are heavily reliant on events, festivals, and large concerts which obviously were put on hold all 2020. When the shutdown first rolled out, the Co-Ceo’s both stopped taking a salary, and Revolve utilized a line of credit to ensure they would stay in business. Since then, especially in 2021, they have come back in full swing with events opening up around the globe which has allowed them to finally build out a healthy balance sheet and drive profit on the bottom line. As you can see in the chart below the low on the daily chart was just below $8 per share which ended 2020 at $31 per share. Normally, I do not focus on price this early in my thoughts, but since I sold this I want to show the price action over the last couple of years.

Revolve breaks itself down into the following segments:

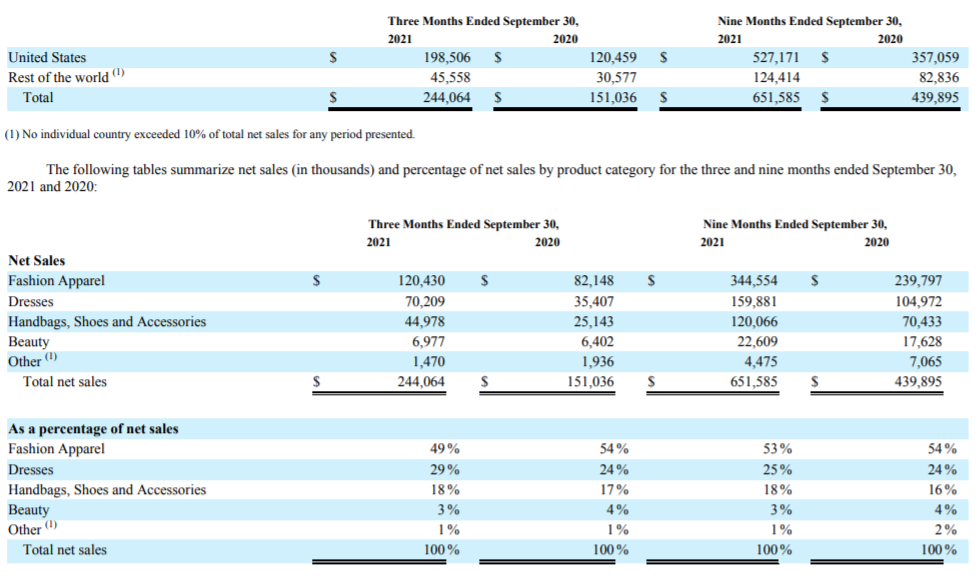

When taking a look at their sales from their Q3 2021 10Q you can see that they have broken out their sales between their two major brands, domestic vs. international, and the various product categories. Unsurprisingly, the stimulus checks combined with the opening up of the U.S. have allowed Revolve Group to garner more sales that have aided their performance throughout the first 3 quarters of the year. Festivals and large-scale concerts returning is a large part of Revolve’s strategy because they sell dresses and other fashion apparel that is popular at festivals for the female demographic.

Financials:

Total Revenue TTM as of Q3 2021: $792.339M

Profit Margin has been floating between ~10% - 12% over the last year

Current P/E: ~70

EV/EBITDA: ~64.8

Current Cash as of Q3 2021: $221.605M

Total Debt as of Q3 2021: $0.00

Industry

According to a report by researchandmarkets.com, “The luxury fashion market size was valued at USD 110.64 billion in 2020 and is expected to reach USD 153.97 billion by 2026 growing at a CAGR of 5.66%.” (Link) They found that the millennial and Gen Z generations are going to be the primary drivers of growth within this industry.

Revolve will benefit from this new customer demographic because of its business model and its growth through social media. Also, because they use social media and influencers to sell their product it is great that they do not have a debt-loaded balance sheet(They have zero debt actually). While I think the company will grow you will see in a moment why I decided to sell-off.

Why I sold:

Overvaluation -

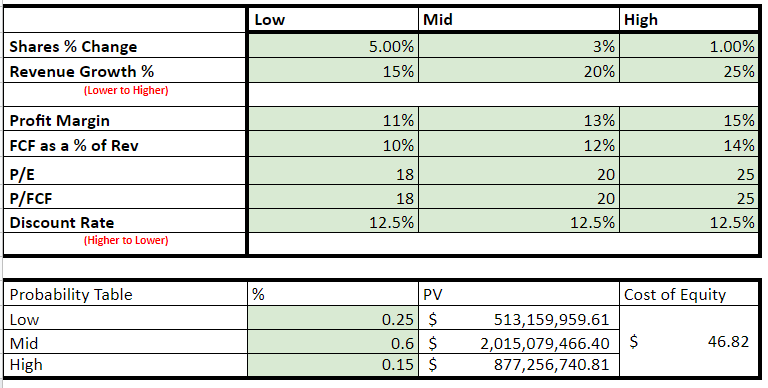

As you can see from the DCF screenshot below, even with some generous growth estimates, P/FCF multiple, and P/E multiple it appears that the company is selling for wayyyyyyy more than what I think it is worth. The original cost basis I had on my position was around $18 per share, but as I was watching the stock price run up more and more I could not justify its short-term growth. I waited till I hit the one-year mark so I could take long-term capital gains rather than short-term capital gains. While I understand that this company’s underlying business model is still going strong I believe that in the short term there will likely be some slowdown and these higher multiple stocks will be the first to get hurt. Also, I am currently looking into other companies that I plan to put that money into as well.

Discounted Free Cashflow Model

If you would like to see my worksheet the link is here.