5 Businesses I am Looking at Currently - August 2022 Edition

I am currently looking at RVLV, TER, KLAC, DJCO, & MU

Hello all! Today we are going to be taking a look at 5 different companies that I think you may need to put on your radar. First, I go through Revolve Group ($RVLV) which I have already done a video with, but I plan to sell another put if my original put expires worthless (Original video here). Second, I mentioned Teradyne Inc. ($TER) which I like from a financial perspective, but I need to understand how it fits in the ecosystem. Third, KLA Corp ($KLAC) has a large market share in the process control business and has had some great financials over the last 10 years. Fourth, Daily Journal Corp. ($DJCO) is a business that has a large investment portfolio along with a lot of off-balance sheet financials that are not currently being accounted for. Lastly, Micron is the value investor stronghold it seems, but I want to research more about this company and why it appears to be so cheap. This will be a quick high-level overview of each company.

The Youtube video link will be here if you’d rather watch than read the article.

Disclaimer: I own Puts in RVLV and do not currently hold equity in any of the other companies at this time. Obviously, this is not financial advice and please make sure to do your own due diligence.

1.) Revolve ($RVLV)

Business Model

Essentially, Revolve Group is a luxury retailer for a primarily female demographic that utilizes social media and data-driven inventory control to maintain costs while getting consumers exactly the attire they want. Revolve and their premier brand FWRD are heavily reliant on events, festivals, and large concerts which obviously were put on hold all 2020. Since then, especially in 2021 & 2022, they have come back in full swing with events opening up around the globe which has allowed them to finally build out a healthy balance sheet and drive profit on the bottom line.

Explain the Developments and Risks

Active customers, orders, placed, and average order value are all trending in the right direction, but please be wary that a lot of it is driven by stimulus checks and spending. What I pay attention to the most is customer retention and customer loyalty to RVLV since recurring buys mean recurring revenue for Revolve. “Existing customers typically place more orders annually than new customers and at higher average order values, resulting in existing customers representing approximately 76% of orders and approximately 77% of net sales in 2021, up from 74% of orders and 76% of net sales in 2020 and 57% of orders and 58% of net sales in 2014, again having increased in each year.” 2021 10K Page 62 Operating Metrics Screenshots

A risk I see is that a lot of their growth post-2019 came from the increase in stimulus checks and income that people had. Revolve had an awesome end of 2020 through Q1 2022 as far as revenue is concerned along with some increasing gross margin. A lot of the sales were made due to everything opening back up at the same time, festivals/events coming back, and of course stimulus checks. While I do not think they will start losing sales in the near term, it is possible we see a slow down due to inflationary pressure, recession fears, and overall consumer spending habits.

One thing I do love about their management (the CO-CEOs) is their ability to navigate the last few years and while the short term of the business was unknown they decided to forego any salary. Now they did this because they own half of the outstanding shares which meant if the business performed then they would make money on the backend. I love that they operate as not just CEOs getting paid handsomely, but they also view this as their business to grow.

Valuation Metrics

Average ROIC is bouncing between 25% - 35% over the last 4 years

PE - 21.36

Forward PE is around 21.69

EV/EBITDA = ~15.77

Am I buying or researching

I currently have sold puts on this company and if you would like to read more about my position I put out an article here.

2.) Teradyne ($TER)

Business Model

Explain the Developments and Risks

Risk: The market for our test products is concentrated with a limited number of significant customers accounting for a substantial portion of the purchases of test equipment. A few customers drive significant demand for our products both through direct sales and sales to the customer’s supply partners. We expect that sales of our test products will continue to be concentrated with a limited number of significant customers for the foreseeable future.

Because of the nature of their business, they are subject to international trade impacts such as tariffs.

“We enter 2022 with strong long-term test and automation demand trends in place and we’ve increased the mid-point of the revenue and non-GAAP earnings per share estimates in our 2024 earnings model to $4.9 billion and $8.00 respectively. However, in 2022, we expect a slower technology transition in one of our major end markets to result in lower System-on-a Chip test demand for Teradyne before accelerating again during the ramp of 3nm production in 2023. In Industrial Automation, we expect high growth to continue in 2022 on the strength of favorable global economic trends and the powerful value our automation products provide to customers.”

“We delivered first quarter results ahead of the midpoint of our January outlook as we successfully resolved some short-term supply constraints at Universal Robots,” said Teradyne President and CEO Mark Jagiela. “Entering the second quarter, the demand environment in test has incrementally improved from our January outlook with particular strength in automotive and Flash memory end markets. In Industrial Automation, both cobot demand at Universal Robots and autonomous mobile robot demand at MiR remain strong and we expect the revenue growth rate to accelerate through the year. From a supply perspective, we continue to encounter material constraints in most product areas and our wider than normal Q2 guidance range reflects those supply challenges.”

Teradyne’s Board of Directors declared a 10% increase in the quarterly cash dividend to $0.11 per share, payable on March 18, 2022 to shareholders of record as of the close of business on February 18, 2022. The company also expects to repurchase a minimum of $750 million of its common stock in 2022. They repurchased $201 million in Q1 2022.

Valuation Metrics

Average ROIC is bouncing between 10% - 20% over the last 5 years, but it has a very high cyclicality

PE - 18.74

Forward PE is around 20.75

EV/EBITDA = ~12.15

Repurchasing about 1% of their market cap.

“Teradyne’s Board of Directors declared a 10% increase in the quarterly cash dividend to $0.11 per share, payable on March 18, 2022, to shareholders of record as of the close of business on February 18, 2022. The company also expects to repurchase a minimum of $750 million of its common stock in 2022.“ They repurchased $201 million in Q1 2022.

Am I buying or researching

Still researching! I am trying to read up on other companies in the semi-cap space along with Teradyne to see where it fits in the value chain of the semiconductor industry.

3.) KLA Corp ($KLAC)

Business Model

Explain the Developments and Risks

The increase in semiconductor needs and complexity will benefit companies like KLA Corp over the long term especially because they have such a large market share in the process control segment. Their machines last for years and years, but once they install/deliver their machine they can begin making money through services.

A risk is that they are willing to take on a little more leverage to finance pieces of the business as well as give back to shareholders. They seem to historically manage debt well, but upping the leverage is definitely something I want to point out.

It has a lot of geographic diversification in its sales which can be good or bad depending on how you view us selling products to Chinese companies.

KLA announced a new $6 Billion Share Repurchase Authorization, including approximately $3 billion Accelerated Share Repurchase (ASR) to be completed over the next 3-6 months, with the remaining amount to be repurchased over the next 12-18 months, subject to market conditions. They also announced a 24% increase in the quarterly dividend level to $1.30 per share from $1.05, the 13th consecutive annual dividend increase for KLA. Since its inception in 2006, KLA has grown the quarterly dividend level at an approximately 15% compounded annual growth rate.

Valuation Metrics

Average ROIC is bouncing between 15% - 25% over the last 10 years

PE - 21.46

Forward PE is around 14.73

EV/EBITDA = ~13.79

Repurchasing about 12% of their market cap.

“the Company is announcing authorization from the Board of Directors to repurchase up to $6 billion of the Company's common stock. Management expects to transact this share repurchase authorization in the form of an Accelerated Share Repurchase of approximately $3 billion to be completed over the next 3-6 months, with the remaining amount to be repurchased over the next 12-18 months. This is in addition to the existing share repurchase authorization, which had $699 million remaining as of March 31, 2022.“

Am I buying or researching

I would like to get in around the $280 mark, but I am still researching this company to see if it may be worth paying a premium over another company in the same space. I think I need to understand process control and metrology more to make long-term judgments. More research!

4.) Daily Journal Corp ($DJCO)

Business Model

The Newspaper Publication - This newspaper focuses on legal news and documentation, but has been slowly dwindling down since 2008. They sell advertisement spots in their newspaper.

Investment Portfolio - This is not the full portfolio because they own some foreign companies like BYD that do not show up here and the management does not typically disclose foreign investments if they don’t need to. Munger currently runs the portfolio, but they will need to pick someone else when he leaves.

Journal Technologies - This is a court case management SAAS company that has a lot of off-balance sheets financial due to the way its business model is structured.

Explain the Developments and Risks

The investment portfolio creates a floor in the valuation because at a certain point you are essentially just investing in the stock portfolio while getting the journal technologies and publication business for “free.” Now obviously, it isn’t that simple because you need to understand the investments, but I like their portfolio and am interested to see who runs it in the future.

Journal Technologies has a lot of sales that have gone through the RFP process but have not made it onto the revenue category because they wait to bill until the system is completely online. This will ramp up a system that is going to be very hard and costly to switch off of, but will allow courts to interface with each other much better. They do not have a one-model solution that can cause some issues, but they tailor the software to the needs of the courts. Also, the software is used internationally as well as all over the United States.

A risk I currently see is that the management is very old and there have been complaints about the work culture by many employees who think there needs to be a change in direction work-culture wise. This can tank companies and I am working to understand the issues more currently.

Journal Technologies may not see some revenue from its initial RFP process until 5 - 7 years later depending on the bureaucracy it has to handle which could mean a delay in sales. This can act as a moat once Journal Tech makes it through the whole process because many companies do not want to stick that out.

Their big competitor currently and who holds the largest market share is Tyler Technologies according to Charlie Munger.

Valuation Metrics

Average ROIC is bouncing between 3% - 5% over the last 10 years

PE - 18.53

Forward PE is around N/A

EV/EBITDA = ~3.01

Am I buying or researching

I have been watching a lot of research from Guy Spier and Matthew Peterson on this because I think there is tremendous opportunity here. I just need to understand the Journal Technology side of the business.

5.) Micron ($MU)

Business Model

They sell memory and other semi-products.

Explain the Developments and Risks

They expect DRAM and NAND to continue on their growth trajectory as many other users of memory begin upgrading their systems and products.

In a lot of areas, Micron is the market share leader in an industry where there are only really 3 big players Samsung, SK Hynix, and Micron (DRAM and NAND tech).

The memory industry is very cyclical and has had significant downturns which is why Micron looks cheap now, but it may really be selling for a higher earnings multiple after we see the next few quarters play out.

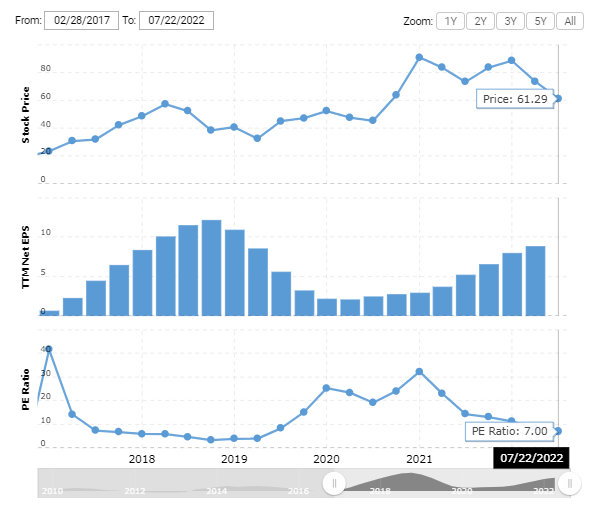

Valuation Metrics

Average ROIC is bouncing between 5% - 20% over the last 10 years.

PE - 7

Forward PE is around 8.66

EV/EBITDA = ~3.61

Am I buying or researching

I just began researching this company.

I know many like seeing a sort of overview like this so I thought I would share what is on my radar currently outside of my current portfolio holdings. Obviously, if I have cheaper opportunities I want to take those, but didn’t want to rehash the portfolio here.