Today, we are going to be taking a look into stock repurchases along with some data points from S&P Global. It is interesting that stock repurchases are truly a more recent phenomenon in the world of investing especially with the lower and lower rates becoming a factor. As with most things in the financial world, when it is done correctly it works amazingly, but in the hands of the wrong person, it may drive a company out of business. I hope you enjoy the quick read and please let me know if you have any questions in the comments.

If you would prefer the explanation in video form you can find my Youtube video here.

What is a stock repurchase?

You may be wondering what is a stock buyback and how is it initiated by a company. From Investopedia, “A stock buyback, also known as a share repurchase, occurs when a company buys back its shares from the marketplace with its accumulated cash. A stock buyback is a way for a company to re-invest in itself. The repurchased shares are absorbed by the company, and the number of outstanding shares on the market is reduced. Because there are fewer shares on the market, the relative ownership stake of each investor increases” (Link). Think of it like this, if you own 10 shares out of 100 total outstanding shares, you own 10% (10/100) of the business. If the company buys back 20 shares, you now own 12.5% (10/80) of the company simply by holding the shares. The goal of buybacks is to reward investors with a bigger slice of the ownership pie so that you will continue being an owner of the business. However, there are many papers that seem to reference that management may put the importance of share repurchasing for investors’ sake while letting the overall company and employment deteriorate.

Now, the stock buybacks can be done with a few methods, but the two I will mention are a tender offer or on the open market. The tender offer allows the company to request a portion of shares from the current holders at a specified price range with which the current holders can accept or decline. The open market method just means that the company will use the day-to-day outstanding shares that are trading hands to buy shares. Sometimes a company may issue an accelerated repurchase(ASR) notification along with a share repurchase program. Below is an example of a share repurchase program along with an accelerated repurchase program.

The History Behind it

Now, stock buybacks were not always legal and they were only legalized in the early 1980s. “In 1982, the SEC enacted Rule 10b-18, which provides a “safe harbor” from liability for manipulation under the Securities and Exchange Act if a firm performs its stock repurchase consistent with the conditions of the Rule. At the time of its enactment, consistent with the anti-manipulation provisions of the Securities and Exchange Act, the Commission intended what became the Rule to be a scheme of regulation that limits the ability of an issuer to control the price of the issuer’s securities’”(Link). Essentially what this rule change did is that it opened the flood gates for corporate executives to use stock buybacks as a way to enrich the shareholders and themselves.

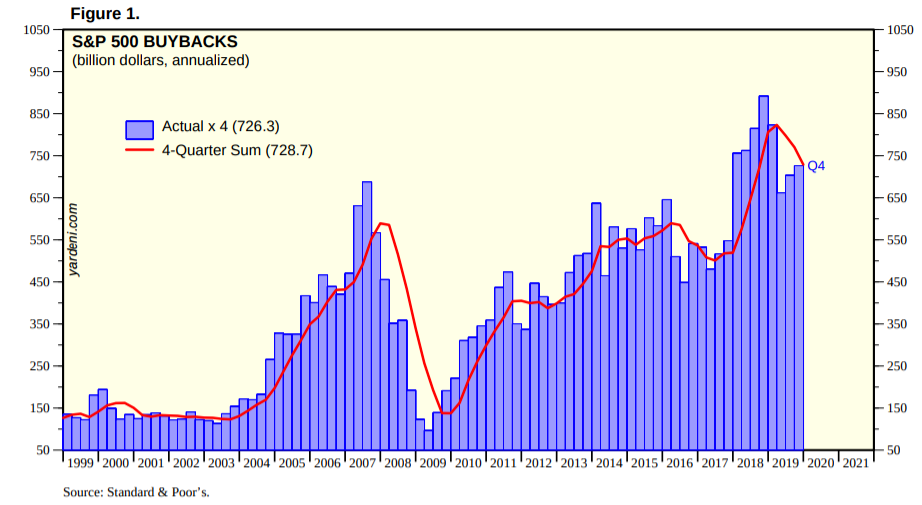

You can see here what that has looked like just in the last 20 or so years:

On top of that, S&P Global put out a research article in which they talked through some different points of a buyback versus dividend portfolio. “From 1994 through 2018, changes in share repurchases and acquisitions were more significant than the other two methods, and this was especially true in 2008 and 2011. In fact, share repurchases follow the economic cycle with increased or decreased activities when the market is up or down. This is not surprising, as free cash flows are often thinner in tough times, and capital expenditures and dividends are usually higher priorities in company spending.” (Link)

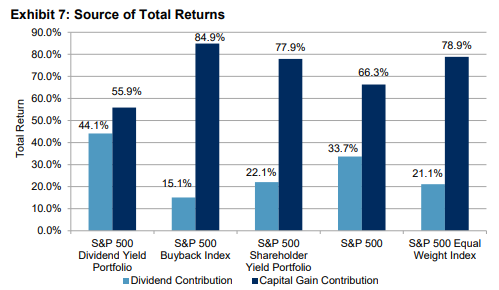

It is definitely interesting to see the Buyback index versus some of the other SP 500 indices as well. You can see that the standard deviation is larger, but returns per year are higher for the buyback index instead of the dividend yield portfolio. Also, the shareholder yield is calculated by adding up the dividends and buybacks as a percentage of the total market cap. I would definitely read through the S&P report to get a better understanding of the different graphs and charts because it is a simple and interesting read.

“As buybacks tend to follow the economic cycle with increased or decreased repurchase activities in up or down markets while dividend payouts are normally more stable over time, the S&P 500 Dividend Yield portfolio tends to outperform in down markets, while the S&P 500 Buyback Index may capture more upside momentum during bull markets.”

While there are more pros and cons than what I am pointing out I thought I would present a few:

Pros

Financial Flexibility

Now one of the big pros for a company, is that since they typically issue a disclosure for the share repurchases, that does not mean that they are required to repurchase all of it within a certain time period unless it is an ASR. Also, since a company may get some of its cash from issuing equity, this allows them to essentially keep the money “within” the company while giving shareholders a bigger slice. Whether they are issuing shares for stock-based compensation or using the proceeds to pay for a project, it means they are going to be able to issue fewer shares later on to get the same proceeds (assuming the stock price goes up).

Tax Efficiency

Now a great part about stock repurchases is that are not taxed at all since all of the gains will be made through unrealized capital gains on the stock price. If you receive a payout via a dividend, you will be receiving the cash that was already net of tax from the corporate level and now will be taxed depending on your income.

Increased Stock Ownership and Price

As mentioned earlier, if the company buys its own outstanding shares your ownership of the business continues to grow. Also, if everything else stays equal, but the outstanding shares the stock price goes up. The way this happens is that imagine if a company is worth $1 Billion dollars and there were 100 million shares outstanding. If the $1 Billion valuation remains the same, but the 100 million shares was reduced to 80 million shares your shares would go from $10 a share ($1 B / 100 M shares) to $12.5 a share ($1 B / 80 M shares).

Cons

Opportunity Cost of the Cash

One of the big issues that many point out is both from the company and social level in terms of the opportunity cost of where that money goes. In terms of the company level, many view companies that are buying their stock back are not investing in future projects or making acquisitions which may hinder future growth for short-term returns. One way to look further into this is to look at the R&D spending and listen to earnings calls or conferences where management talks about their corporate strategy. While it is important that they are concerned about the shareholder’s value, it is very important that they continue to grow the company rather than giving up market share for the sake of buybacks. From the social level, many view that the capital allocated for buybacks may be better spent on compensation or community spending to help society. While these are not black and white issues, it is important you learn about the management to understand what they prioritize.

Agency Problem

Another issue that I read about, was the fact that the shareholders really have no say in whether or not a stock repurchase occurs. Now, if that c-suite and directors are holders of the company stock it may appear that the values should be aligned, but that assumes they see repurchases the way we investors view investing. If they are buying an underpriced stock or do not see a project with equal or more return it is worth repurchasing the stock. If they are buying a massively overpriced stock and ignoring key investments this will spell trouble in the long run. Take a look at Intel, they eroded their market share with the old CEO instead of investing heavily in R&D to make sure they stay in front (Pat Gelsinger seems to be starting the turnaround, but only time will tell).

Deteriorating The Balance Sheet

These three cons probably all go hand in hand with each other, but the last con I wanted to point out is that a company may take on debt to repurchase stock. While the idea is to take out cheap debt to boost equity prices, it is probably not worth deteriorating your balance sheet for the sake of financially engineering your stock. It may work for some companies in the short term, but as a business owner, we are trying to find companies we gain value from over the long term. An example of repurchases gone bad was when the airlines decided to use billions of dollars in cash to buy back their own stock which ultimately hurt their balance sheet and liquidity. When COVID happened at the beginning of 2020, the government had to bail out most of the major airlines because of their irresponsible capital allocation.

Conclusion

In conclusion, stock repurchases can be very useful and rewarding when they are used under the right company and at the right time. One point to look for in a company is management that is properly allocating its capital and is not trying to do one last hoorah before the company comes crashing down. There may be opportunities where a company issues a dividend, issues a stock repurchase agreement, and is contributing to its own growth through R&D or acquisitions. You want to be in companies that view the business how you want the business to be run and if you do not like how the business is run then you can look elsewhere. Do not automatically think a stock repurchase is a good thing.

Happy investing and thank you for reading!