Introduction:

I decided to continue on my journey through the semiconductor and semiconductor equipment companies. Teradyne was a company that I have been following for the last two years and was researching prior to the October 2022 issues in the industry. I did not feel comfortable with my analysis just quite yet, but obviously, that was prime buying time. Now I think it is closer to fair value and one that I have on my watch list around the low 80’s.

If you would like to watch my Youtube video explanation click here.

Disclaimer: I currently do not have a position in this company.

TER - Teradyne Inc.:

We design, develop, manufacture and sell automatic test systems and robotics products. Our automatic test systems are used to test semiconductors, wireless products, data storage and complex electronics systems in many industries including consumer electronics, wireless, automotive, industrial, computing, communications, and aerospace and defense industries. Our robotics products include collaborative robotic arms and autonomous mobile robots (“AMRs”) used by global manufacturing, logistics and industrial customers to improve quality, increase manufacturing and material handling efficiency and decrease manufacturing and logistics costs” - 2022 10K Page 4

Teradyne breaks itself down into the following segments:

“ The Semiconductor Test segment includes operations related to the design, manufacturing and marketing of semiconductor test products and services. The System Test segment includes operations related to the design, manufacturing and marketing of products and services for storage and system level test, defense/aerospace instrumentation test, and circuit-board test. The Wireless Test segment includes operations related to the design, manufacturing and marketing of wireless test products and services. The Robotics segment includes operations related to the design, manufacturing and marketing of collaborative robotic arms, autonomous mobile robots and advanced robotic control software. ” - 2022 10K Page 100

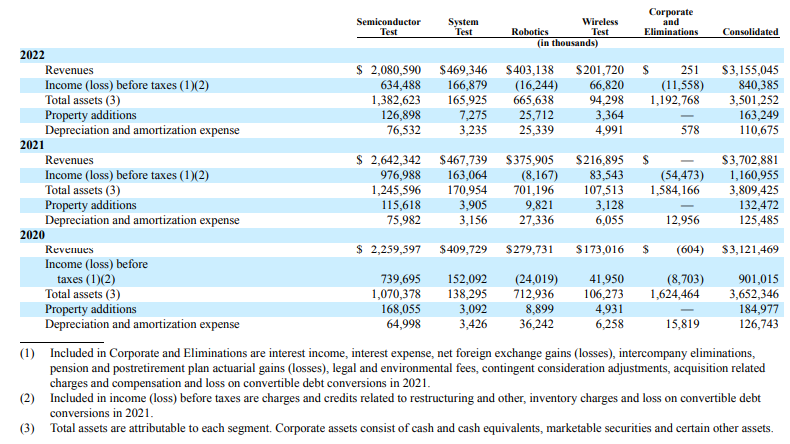

From 2022 10K:

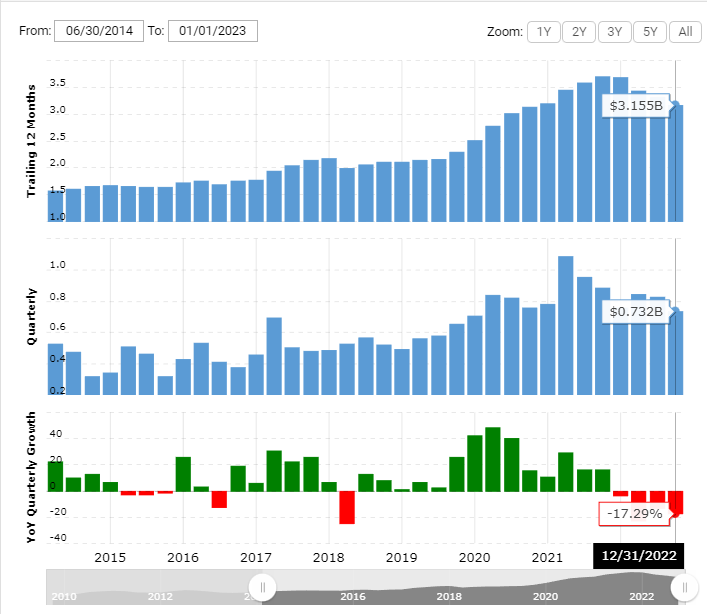

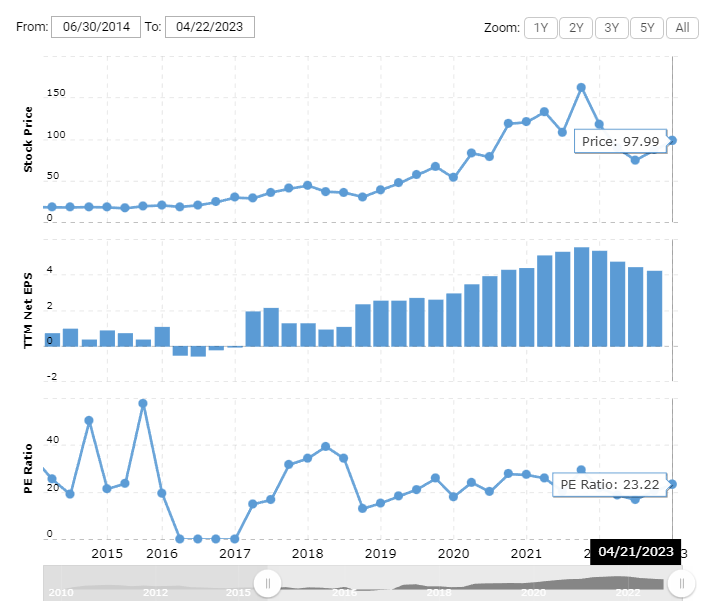

Financials:

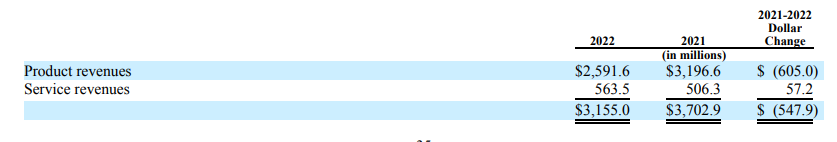

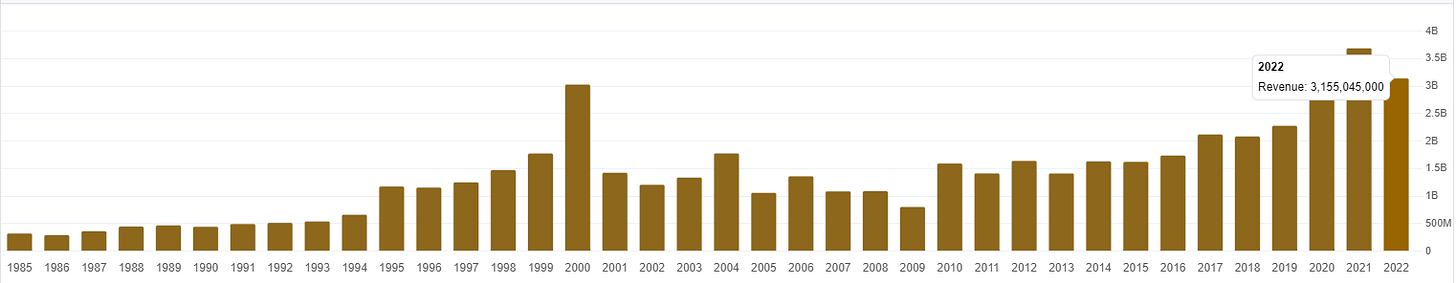

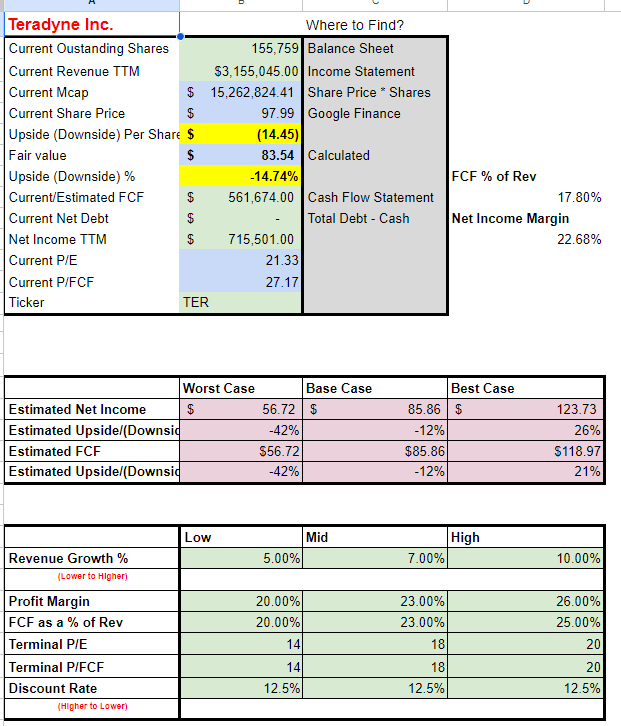

Total Revenue TTM as of Q4 2022: $3.155B

Profit Margin has been floating between ~20% - 25% over the last few years

Current P/E: ~24.96

EV/EBITDA: ~15.68

Current Cash as of Q4 2022: $854.773M

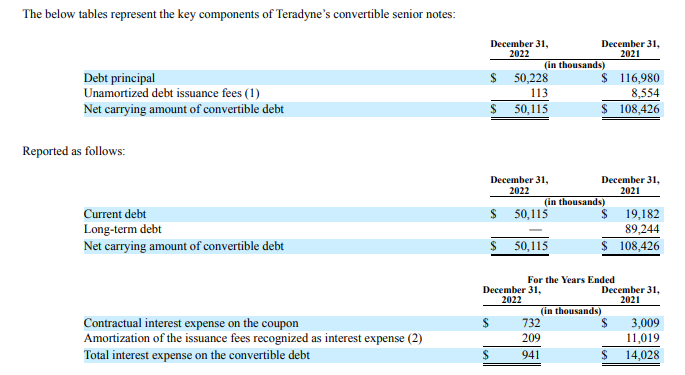

Total Long-Term Debt as of Q4 2022: $0.00B

On December 12, 2016, Teradyne completed a private offering of $460.0 million aggregate principal amount of 1.25% convertible senior unsecured notes (the “Notes”) due December 15, 2023. As of February 22, 2023, one hundred and twenty-four holders had exercised the option to convert $424.9 million worth of notes.

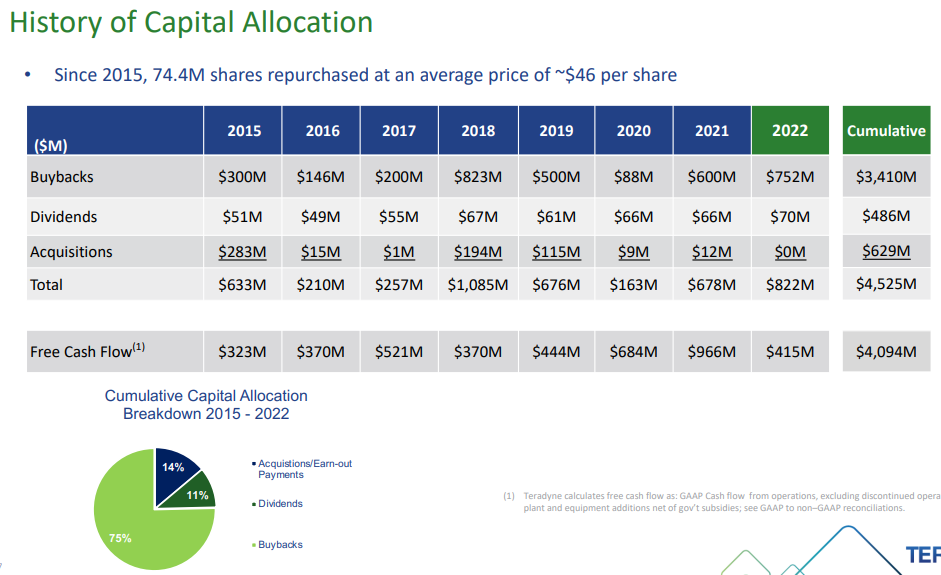

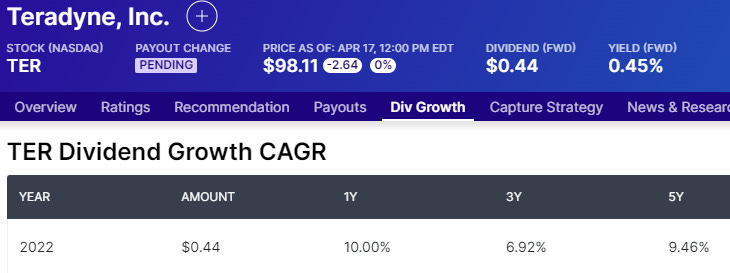

The company has been repurchasing shares and issuing a dividend with increases in the payout over the last few years. In January 2021, the Board of Directors authorized the repurchase of up to $2.0 billion of common stock. In January 2023, the Board of Directors canceled the 2021 repurchase program and approved a new $2.0 billion of common stock. Unless terminated by the resolution of our Board of Directors, the repurchase program will expire when we have repurchased all shares authorized for repurchase under the share repurchase program.

Industry

Semiconductor test equipment market

The global automatic test equipment market size was valued at $6.44 billion in 2020, and is projected to reach $9.52 billion by 2030, growing at a CAGR of 4.2% from 2021 to 2030. - Allied Market Research Teradyne had stated that there would be a slowdown in the semiconductor market over the short term, but as 3nm starts to make its way into production we may see some healing during 2023.

Industrial Automation

Collaborative Robot (Cobot) Market size was valued at USD 1.6 Billion in 2021 and is projected to reach USD 16.8 Billion by 2030, growing at a CAGR of 40% from 2022 to 2030. (Verified Market Research) Cobots are an unsurprising growing field in the world of industrial automation, but to what level Teradyne’s total addressable market is still a little early to assume. Industrial Automation will likely make some great strides over the coming decade and competition will likely increase more than in the ATE industry.

Strengths:

Robotics Growth

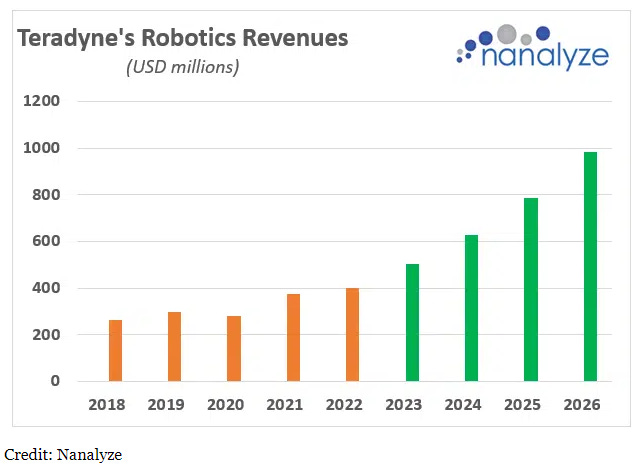

This section is half strength half weakness. It really depends on your perspective, but I figured I would mention both sides anyways. To give you an idea of what kind of growth Teradyne experienced through the acquisition of Universal Robots in 2015 here it is(link). Teradyne acquired this company for $285M and has made some great strides to build out the sales. They merged the companies under their AMR portion of robotics which will allow the company to move forward with growth in the Robotics arm of their business.

Nanalyze.com has been following the story of Teradyne and it looks like the CEO has set some aggressive (overly aggressive goals?) for their robotics division. “The big announcement was that the company believes revenue from robotics will hit $1 billion, representing about 20% of total revenues by 2026. The new CEO, Greg Smith, was most recently president of the IA group, so presumably, he knows what he’s talking about. To hit this target, the Industrial Automation segment would need to grow by a 25% compound annual growth rate (CAGR) over the next four years (reflected below in green).” (link) While I like the robotics growth, I think 25% CAGR may be too tall of a task for a company like Teradyne. If they do hit that goal though you know that they will see some significant appreciation.

High Barriers To Entry

“Teradyne makes considerable investments to develop new products. As Jagiela told me, “New semiconductor test equipment is very complex. It takes 400 to 600 engineers four to five years and costs $1 billion. We’ve been fortunate to suffer very low turnover — around 2% — among our engineers. This gives us accrued knowledge which benefit product development, deepens our domain knowledge, and enables us to be more advanced than the competition. The industry has consolidated since the 1990s. As he said, ‘There are high barriers to entry and between Teradyne and [Advantest}, we control 90% of the market — which is growing at a 7% to 9% annual rate.’” - Forbes C.J. Muse from Evercore has Teradyne’s market share at around 37% of the SOC test and asked management about it during the Q4 2022 earnings call. Greg Smith did not deny the market share in the question but stated that there would be some market share recovery this year from Teradyne(Q4 2022 Earning Call).

Services Revenue

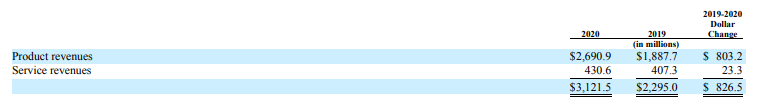

As I mentioned in my KLAC article, these semi-equipment companies benefit from continuing to service equipment. In 2019 the full-year sales from services came out to $407.3M and increased to $563.5M in 2022. Obviously, the product revenue may eke out hire or lower depending on where the company is in its sale cycle, but the service revenue will help over the long term.

Weaknesses:

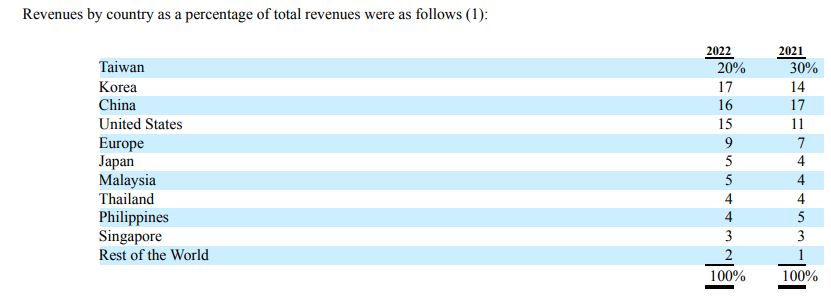

Foreign Revenue

Exposure to China and Taiwan means that there could be some weakness if the United States decides to limit the production of advanced semis and equipment in China. The most recent big example was the announcement of the ban on advanced chips in Oct 2022. (Link)

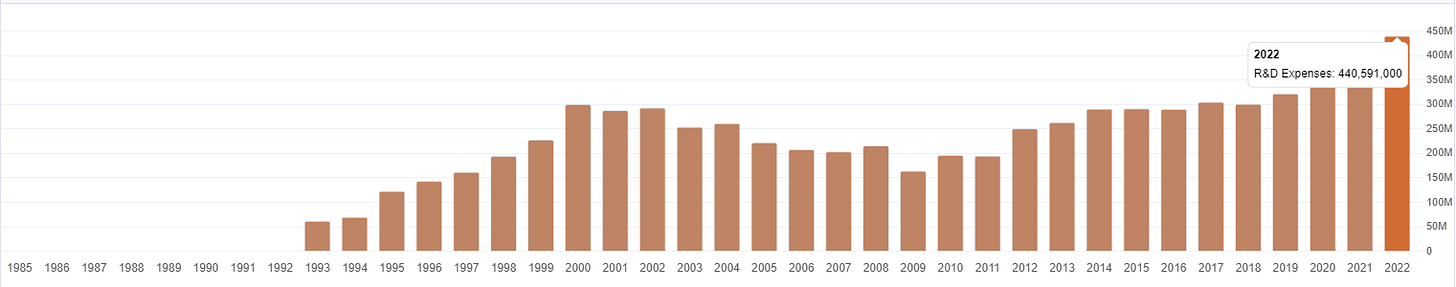

Continuous Research and Development

With a business model based on continuously keeping up with the new nodes that are reached, it is important to note the amount of R&D needed to keep up with the ATE portion of their business. As you can see in the screenshots below R&D has steadily gone up, but it has remained at or under 15% of revenue for quite some time. At this moment I do not think this is an area to worry about, but it is something to watch on the net income statement.

Concentrated Market

“The market for our products is concentrated with a limited number of significant customers accounting for a substantial portion of the purchases of test equipment. In each of the years, 2022, 2021 and 2020, our five largest direct customers in aggregate accounted for 26%, 33% and 36% of consolidated revenues, respectively. We estimate consolidated revenues driven by Qualcomm, a customer of our Semiconductor Test, System Test, and Wireless Test segments, combining direct and indirect sales to Qualcomm, accounted for approximately 11% of our consolidated revenues in 2022 and less than 10% in 2021 and 2020. We estimate consolidated revenues driven by one OEM customer, of our Semiconductor Test and Wireless Test segments, combining direct sales to that customer with sales to the customer’s OSATs (which include Taiwan Semiconductor Manufacturing Company Ltd.), accounted for less than 10% of our consolidated revenues in 2022, and 19% and 25% of our consolidated revenues in 2021 and 2020, respectively” (Page 16 2022 10K)

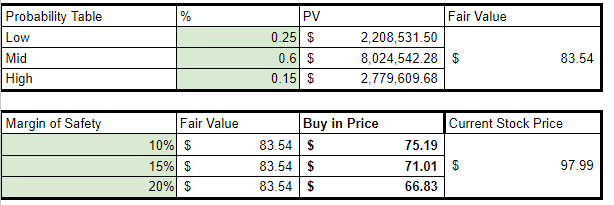

Intrinsic Value:

Link to discounted cash flow here.

Conclusion

As of right now, I am going to wait and see if we get another downturn in the semiconductor industry to begin a position. There have been hints at slowdowns in cap-ex spending so I am very curious to see where the equipment side of the business goes. Also, since Teradyne is not strictly reliant on personal computing, but also has its hand in cellular devices we may see some hiccups there as well. I will continue learning about this business and the industry then notify you with my portfolio updates if I make any purchases. Owning businesses is the goal and I want to continue on my knowledge journey.